Tax Preparation

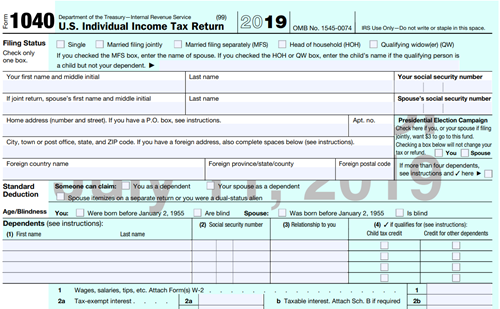

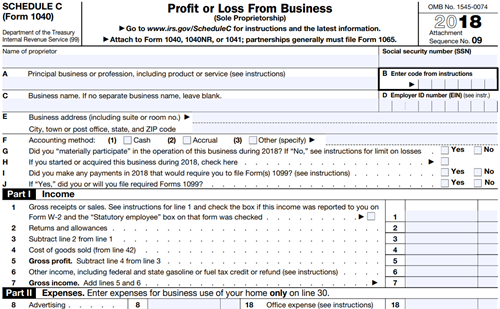

Entrepreneurs/subcontractor returns (Schedule C) is submitted in connection with 1040. A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

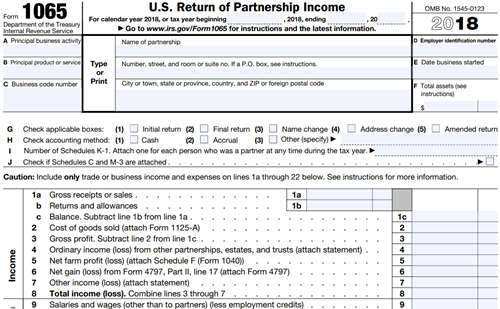

1065 (partnership returns) Client will send a form for this section.: Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. A partnership does not pay tax on its income but “passes through” any profits or losses to its partners on a Schedule K-1.

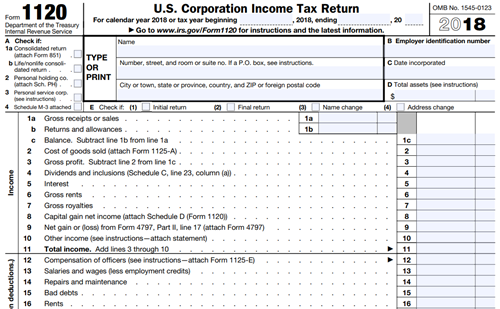

1120 (corporation returns both C and S) , officially the “U.S Corporate Income Tax Return” is one of the IRS tax forms used by corporations (specifically, C corporations) in the United States to report their income, gains, losses, deductions, credits and to figure out their tax liability. It serves as a pass through entity of the income to the 1040.