IRS Representation

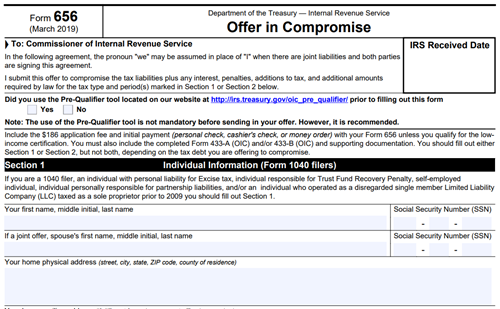

Offer in compromise – The Offer in Compromise program, in the United States, is an Internal Revenue Service program under 26 U.S.C. § 7122 which allows qualified individuals with an unpaid tax debt to negotiate a settled amount that is less than the total owed to clear the debt.

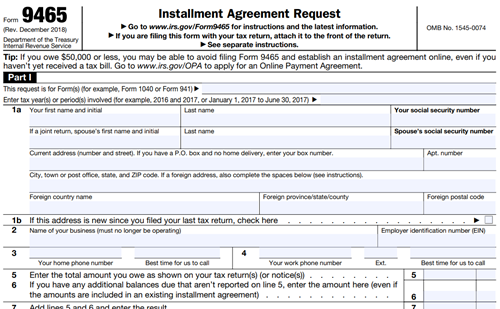

Installment Agreements – By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline. A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. If the IRS approves your payment plan fees may apply

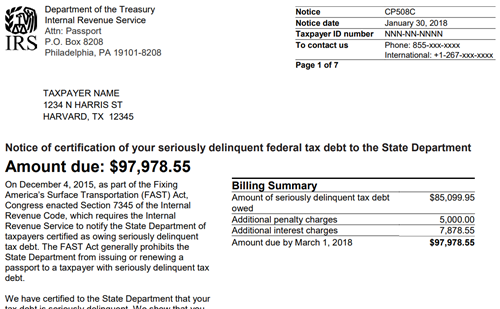

Delinquent tax relief – Delinquent taxes are a result of a failure to file taxes or a missed tax return payment. A delinquent tax return notice from the IRS is the first of many, so you still have time to fix things before they escalate.

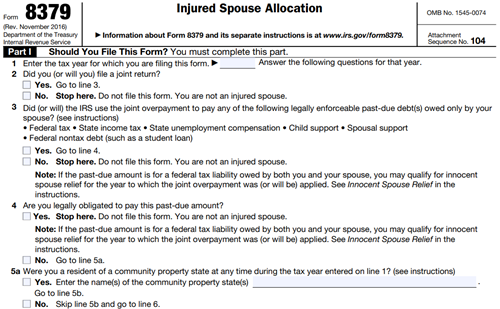

Innocent/injured spouse – By requesting innocent spouse relief, you can be relieved of responsibility for paying tax, interest, and penalties if your spouse did something wrong on your tax return.